Leveraging Fintech for the Growth of Telecom

The telecom industry is at a crossroads. For years, telecom solution providers have fought to stay relevant—slashing prices, upgrading networks, chasing efficiency—only to watch margins shrink as competition grows fiercer. Over-the-top (OTT) platforms chip away at traditional revenue streams, regulations tighten, and customers demand more for less. But there is a game-changer hiding in plain sight: fintech.

No longer just a buzzword, fintech has become the go-to technology telcos have come to rely on. It is not about adding another service; it’s about rewriting the rules of engagement. Imagine turning every SIM card into a financial gateway, every customer interaction into a revenue opportunity, and stagnant data into actionable intelligence. The shift is already underway. From Kenya’s M-Pesa to MTN’s Mobile Money, forward-thinking operators are proving that telecom’s future is not just in calls, messages, or data—it’s in powering economies.

This blog isn’t just about why fintech matters, it’s about how to harness it better. We’ll explore the five powerful benefits fintech brings to telecom and reveal what separates the winners from the ‘also-in-the-run’ players.

How Fintech Benefit Telecom Operators?

Fintech is not just becoming a revenue arm for telecom solution providers; it is also offering other benefits to them. Through fintech, operators are shifting from being a connectivity provider to ‘techno.’ Let us discover them:

Creates revenue diversification

Revenue diversification through fintech solutions is not about making extra money but about future-proofing an industry against stagnation. Fintech opens the door to higher-margin, infrastructure-light revenue models for telcos. Operators can now monetize financial transactions, credit services, and embedded finance, where margins are higher, and the churn is lower.

Take Safaricom PLC in Kenya; in 2024, their mobile payment service, M-Pesa, grew 16.6% year-on-year, compared to just 4.8% in enterprise telecom. Businesses that recognize fintech as a core driver will lead the next phase of digital finance.

Future-proof against economic downturns

The telecom industry runs on high fixed-cost models, which can make them vulnerable to economic downturns. Fintech adds a layer of resilience for telecom operators; services like micro-loans, BNPL (Buy Now Pay Later), and insurance are in demand. Thus, providing telecom solution providers with business continuity during slowdowns.

MTN’s Mobile Money Platform offers short-term credit to its users in Uganda through a partnership with the JUMO platform. The loans are available to customers for 60 days. So, instead of losing customers who cannot afford top-ups, MTN keeps them engaged through short-term financing and ensures growth.

Turns telecom data into an asset

Telecom operators own one of the most valuable data of the digital economy. Recharge frequency, bill payment cycle, and usage behavior of their customers are all data that form the foundation of building intelligent financial products. They can convert this data into revenue by partnering with a fintech company or adding advanced AI analytics.

Telcos can launch real-time offers based on customers’ usage and find creditworthiness with repayment cycles. They can also sell this data to fintech companies, banks, and government agencies. Airtel and Jumo in Africa built an AI-powered credit scoring engine that predicts repayment ability based on mobile data usage, allowing Airtel to sell credit insights to banks.

Deepening customer relationships

A telco that enables a financial journey rather than just a recharge for their customers is far better. Fintech allows telcos to meet their customers where they are, giving them the power to make payments, make local transfers, make international payments, send gifts, and more. All these features remove the need for physical cards.

Benefits such as Buy Now Pay Later (BNPL), discount coupons, cashback on a transaction, and loyalty rewards are more than just convenience. They are behavioral hooks that create deep, recurring customer engagement and promote inclusion. With telecom solution providers continuing to invest in more layers of fintech services like personalization, the engagement is going to increase.

Reduces customer churn

Customers who rely on their telco for connectivity will switch to another operator if they find a better service. But, with fintech services, customers rely on telecom providers for payments, microloans, and insurance. This increases dependency as well as touchpoints, which reduces the churn.

Real-world examples validate this: M-Pesa by Safaricom saw a 16.6% growth with a 13.1% growth in Average Revenue Per User (ARPU). Similarly, MTN’s Mobile Money users showed a churn rate of just 0.2% over three months, compared to 4.5% among non-fintech users, an 11x difference.

How successfully have telecom operators monetized through fintech?

Many telecom operators have ventured into fintech, yet only a few have emerged successful. The differentiator lies in offering financial services and strategically aligning these with market needs and execution capabilities. Here is precisely what the telco leaders did differently:

Forming strategic partnerships with fintech players

Telcos that attempt to build fintech capabilities from scratch, often face steep costs, long timelines, and complex legacy integration issues. The smart ones bypass these hurdles by forming strategic partnerships with fintech players. These partnerships offer immediate market entry, proven technology, and stable operational models, allowing telecom solution providers to scale quickly without heavy initial investments.

Investing in R&D to integrate fintech

White-label fintech solutions offer quick wins but come with limitations—data dependency on third-party providers, limited differentiation, and minimal control over the user experience. To overcome these challenges, telecom operators invest in proprietary fintech platforms to retain full data ownership and customize user journeys.

Focus on financial inclusion

Operators prioritizing financial inclusion by targeting underserved markets rather than saturated ones will outperform. Successful telcos like Safaricom (Kenya) and Telenor (Pakistan, Bangladesh) deliberately target underserved segments. By providing accessible, mobile-first financial services, they have unlocked sustainable revenue streams and expanded their user bases significantly beyond traditional telecom services.

Partnering with other telecom players

Leading telcos increasingly partner with regional or global operators to leverage complementary customer bases. Shared fintech platforms enable cross-operator transactions, expanding reach without heavy marketing spending. Ericsson and MTN’s extended partnership in Africa exemplify this approach. Ericsson’s Wallet Platform is leveraged to empower millions financially, significantly broadening fintech reach and driving collective growth.

Facilitating cross-border payments

Another growth driver for telcos leveraging fintech successfully is facilitating cross-border payments. By removing intermediaries, telecom companies offer instant, low-cost international transfers, leveraging growth for their business. Orange Money, an example of this, enables seamless cross-border payments across multiple African countries. As a result, the operator captures significant transaction volumes previously monopolized by traditional remittance providers.

What should telcos be mindful of?

The opportunity to pair fintech solutions with telecom offerings is enormous. But it comes with its own set of challenges. Addressing them will help telecom operators create successful business models.

Technological integration

The biggest challenge in telco-fintech integration is not innovation but the legacy infrastructure. Telecom companies’ networks were designed for connectivity and not to handle real-time financial transactions. Rigid legacy infrastructure paired with banking-grade security and compliance creates a contradiction.

Collaboration with fintech companies would help telcos solve the integration problem. Instead of rebuilding the entire telecom structure, which will burn a hole in their pockets, leveraging fintech platforms can assist them in bypassing legacy infrastructure.

Security Concerns

As telecom solution providers venture into fintech, regulators and customers expect them to maintain the same level of security as banks or fintech providers. Operators cannot assume that their existing security is enough to protect real-time payments, credit services, and digital wallets.

By adding fintech solutions, telecom businesses should consider the challenges of external and internal threats. Without a financial security framework, operators can risk losing credibility, facing regulatory fines, and experiencing reputational damage.

Regulatory Constraints

Telcos entering fintech must understand that financial regulations are strict, multi-layered, and constantly evolving. The laws in telecom and fintech often overlap or conflict, creating uncertainty about which rules to apply.

A single compliance failure can lead to massive fines, market restrictions, or license revocation. So, entering the fintech space without proper regulatory knowledge would be a mistake. A straightforward solution would be to partner with a financial institution or use their expertise in regulatory frameworks to offer services across different geographical regions.

Final Thoughts

Today, telcos are standing at the edge of a trillion-dollar shift. Those who continue to think like telecom solution providers will lose ground to those with digital capabilities, owning networks and financial ecosystems. The telco-fintech convergence is not about entering the financial services space. It is about becoming indispensable for customers by controlling how money moves, is accessed, and is experienced.

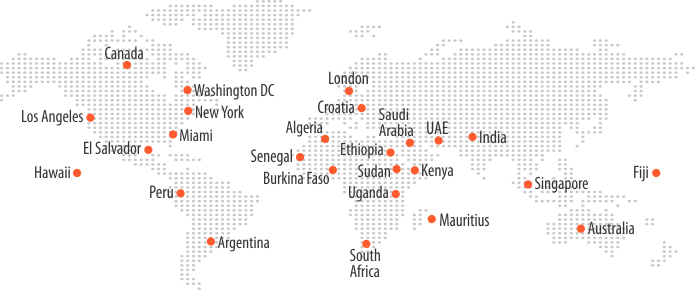

At Bankai Group, we understand this shift and are at the forefront of this convergence. Through our fintech solutions, we empower telecom operators to offer innovative and customer-centric services that promote financial inclusion. To propel your business to become the next digital enabler in your region, contact our global experts now.