How COVID-19 Helped Transform the Telecom Wholesale Industry Landscape?

Every industry has experienced major impact since the onset of COVID-19, and telecom industry is no stranger. Undeniably there have been some major disruptions in the telecom space. The industry has seen close to 80% dip in international roaming clearly due to the lack of travel. Similarly, there are other telecom services that have also suffered. But on the bright side, digital transformation has already taken over the world, and the telecom space has clearly shown how important is this industry during the pandemic. Be it businesses, schools, governments, or enterprises, all entities are functioning only because of the connectivity provided by the telecom companies when our conventional activities and processes were skewed. What does this current situation mean for the wholesale carriers? How can they continue to modernize their business models through innovation and collaboration to build added resilience? How to ensure continued growth with Wholesale VoIP Solutions? Let’s read through this blog to understand more.

Market Disruption – Now and Beyond

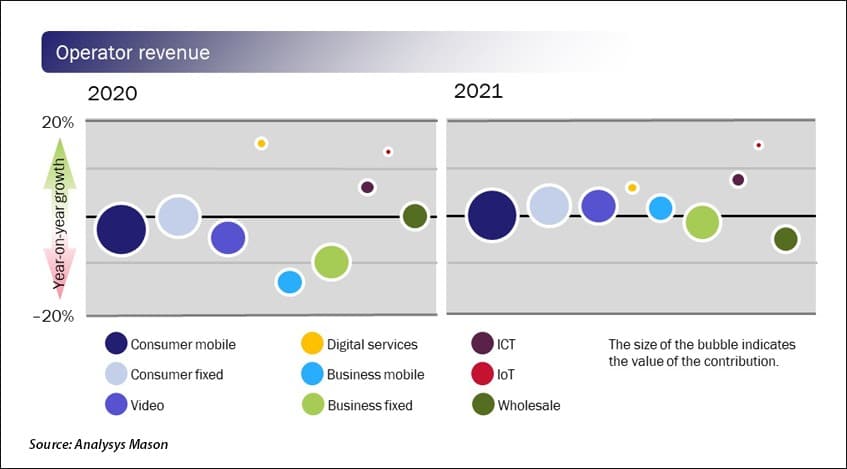

The telecom industry has always been critical, but these are crucial times due to high performance demands. It is a resilient sector and is expected to perform ahead of the global GDP trends. During this economic crisis, the consumer telecom market is also likely to remain resilient due to remote working and other digital initiatives and may drop marginally by 0.5-1.2% by the end of this year. However, there’s an expected increase in Digital Services/IoT revenue by 15%, that is 6% higher than previously estimated.

The wholesale Voice carrier domain covers discrete components that are subject to a variety of market dynamics. Capacity wholesalers are witnessing tremendous growth due to the rise in demand for OTTs. At the same time, wholesale access and Unified Communications platforms are also driving last mile with the global connectivity surge. It is expected that there will be 5 time more traffic from Instant Messaging platforms by the end of 2020.

Key Role of Wholesale Carriers during COVID-19

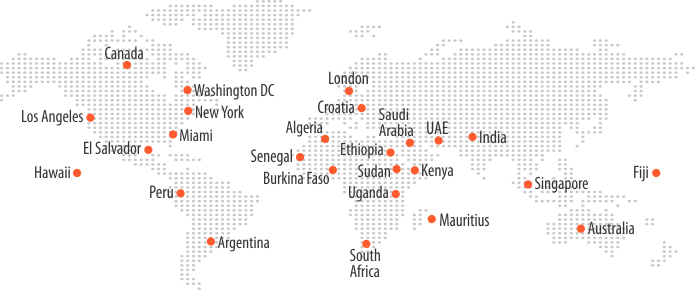

- International wholesalers transport major international voice traffic annually

- Connecting remote countries in continents like Africa to the world

- Enabling global access for increased demand of bandwidth and connectivity

- Helping the customers of local telecom companies to gain global access

- Global wholesale providers playing critical role in enabling business continuity during pandemic

- Enabling capacity demands of OTTs due to more flexible and agile business models

- Driving remote business growths through UC platforms and other digital initiatives

- Focusing on network expansion and embracing wholesale IoT and 5G services

The Rise of Wholesale Carrier Industry Post COVID-19

Digital is the way moving forward and the wholesale industry likewise is also moving in that direction. We have seen an immense growth in areas like cloud services, machine learning and IoT services that reflect the growth potential in the industry. Wholesale carriers are no more voice and SMS centric, and are becoming facilitators for global network coverage.

The wholesale industry can be segregated into three key layers – on top we have global operators with global presence and wholesale players with network and connectivity in multiple countries. The second layer comprises of tier-2 wholesale players with strong presence in their own continent or a set of countries. On the third layer sit the tier-3 carriers with more focused approach. This led to competition among the operators and wholesale carriers over revenue. However, during the past one year we can notice that operators are focusing on evolving areas in the industry and are now getting along with wholesale voice carriers with extensive network to help them compliment their existing value chain.

Thus, collaboration between operators and wholesale players is driving tech initiatives like blockchain and IoT. Moreover, wholesale players are diversifying their portfolio with Unified Communication, A2P SMS (Enterprise Messaging) to add incremental revenue to Operators Carrier Division Profit and Loss. Not to forget that they are sharing information and preventive telecom solutions to avoid telecom frauds in international voice and messaging.

The Shift from Wholesale Trading to Managed Services Approach

In the recent times we have seen major transformation in the carrier industry. Earlier the operator used to work directly with carriers based on the size and domicile of the operator while the voice, SMS and data traffic was received through multiple carriers. This approach was becoming cumbersome for operators as they had to manage everything on their own including maintaining quality networks. However, during the pandemic we’ve noticed that operators are adopting the managed services approach to manage their carriers, customers, and becoming a one-stop shop to terminate the outbound traffic as well. Thus, managed services link operators to the outside world and offer a variety of services to the end customers. Now that the operators want to focus more on their network optimization side, this concept is helping them maintain real-time control of existing international voice business, manage operational activities, and reduce traditional risks and OpEx, allowing them to focus on core business areas.

Managed services are nothing but the process of outsourcing non-core wholesale carrier activities to global wholesale VoIP solution providers in a bundled, personalized solution based on operator’s needs. Online tools are used to access reports – traffic data, traffic values and quality overviews, providing complete automation, control and visibility over business operations. BridgeVoice Pluto, available as Express Service or White Label, is one such solution that offers premium trading, routing and settlement platform for wholesale carriers, simplifying back office operations while reducing OpEx. The platform has acted as a comprehensive interface for global communication needs especially during COVID-19.

Forecast 2025

This year was full of surprises even in the field of voice technology and telecom wholesalers must take advantage of digitization to achieve long-term business growth. Let’s take a look at what stands ahead for the future of telecom wholesale to survive in the competitive landscape.

New Incremental Forms of Demand for IP Voice

Technologies such as High Definition Voice and Hyper Voice, appear to be due for significant growth in the next 3-5 years. Two-way video, unified communications, femtocells (where voice is one its constituent services) and gaming will be growth drivers with ‘voice-like’ quality needs.

Beyond the Pipe

Innovation and technology are key for the telecom wholesale industry. Increased digital transformation will provide the wholesale industry several opportunities to extend revenue streams beyond connectivity, including IoT solutions and Virtual Reality. OTT /enterprise customer base capacity demands will be served by wholesale carriers in real-time with demand management platforms.

The Power of ‘Platforms’

Majority of the wholesale carrier industry will embrace platform-based business models to meet their customers’ evolving demands similar to what Amazon or Uber are currently doing. APIs will become more commonplace within the wholesale communication industry that could be bundled with cyber security and AI-based routing and fraud alerts.

Mergers and Acquisitions

Carriers will evolve as independent entities for the global communication needs. With the increase in M&As, we will see a fair amount of consolidation happening in the industry by 2022. The carrier business incumbents too are seeking inorganic growth by acquiring strategic carriers, that complement their existing value chain.

Building a Trust Network

The telecom industry has truly been world’s backbone during this pandemic, providing the access, communication, and services for both businesses and personal communications. Millions of businesses transitioned quickly continuing those strategies as we move through this pandemic into 2021. We also witnessed significant growth in several businesses, voice and video traffic as well as telecom networks. This goes without saying that the wholesale carrier industry added value to all the other industries. Bankai Group embraces innovation and technology with telecom solutions as bundled services and develop a trusted, collaborative partnership to help businesses like yours meet customer demands.

Related Posts

Top 5 VoIP Trends To Watch Out For Post COVID-19

Battling Telecom Frauds During COVID-19

Webinar Co-Speaker – Aayush Barot hails from Mumbai and is now based out of New York. He completed his Bachelors in Business from Jai Hind College Mumbai and has earned various accolades as an independent professional for Business and Marketing. He is an ardent fan of his business and considers work as a way of relaxation. Today he is the Chief Business Management Officer at Bankai Group, where he started as a Sales Executive, 11 years ago. Aayush comes from a Hospitality Business Family but chose to do something entirely different into Telecommunications. He handles Voice and Services portfolio for Bankai Group and has steered the growth of business by almost 40% year on year. Under his leadership, the Voice Vertical grew from $50 million/year to $340 million/year from 2005 to 2015.

Contributing Writer: Neha is a digital marketing evangelist with over a decade of marketing experience and currently overlooks the entire inbound marketing activities and manages the team. She’s adept in marketing planning and execution as well as content management for strategic utilization and deployment of available resources to achieve organizational objectives. Neha is a nomadic traveler who loves to meet new people while travelling and enjoy reading travel articles. Connect with her on Linkedin.