Key Aspects Required by the Global Industry for Mobile Finance Technology

Mobile Finance – The Need for Optimized, Flexible Software Solutions Which Cover All Market Segments

Technology is one of the foremost enablers of inclusive growth in societies. The biggest example of this is Mobile Technology unlocking the growth potential of hitherto underdeveloped societies.

In the world of Mobile Technologies, the Mobile Finance area has contributed greatly towards inclusive growth in Emerging markets, by opening up new business and transaction opportunities.

The Mobile Finance industry faces budgetary, regulatory, and infrastructure pressures in emerging markets. They need optimal and flexible software solutions addressing all market segments.

I am listing further below in this blog some key aspects in relation to the above that the industry is looking for in Mobile Finance Software solutions.

Flexible and Customizable Solutions Needed

The Mobile Finance Industry is vulnerable to changes in regulations e.g. a regulator suddenly stipulated that Cash Outs are not allowed. They need a software platform which can be easily customized or changed to continue business while adhering to these regulatory changes.

The requirements of these markets change very fast with entry into newer areas like Power Utilities etc, and with technology changes like frequent launch of new handsets. Additionally, each service provider’s business is unique with specific requirements. They need a software solution which can be custom deployed for them and can be easily changed in a project based approach, rather than a product based approach with a rigid set of features. Cost wise and business operations wise, flexible and customizable solutions deployed using a project based approach is the need of the day.

Another very real requirement in these markets, is the need for local language support and to be able to work with newer industrial domains e.g. Utility companies (Prepaid Electricity, Water etc ). The software solution used by Mobile Finance Service providers should be able to address this. E.g. Code base can be developed using PHP language to support almost every language in the world very easily. Also, it should be able to easily work with newer industrial domain standards and APIs.

Smartphone Support Is Mandatory – But don’t forget the good old Java/J2ME/Symbian Phones

In the target emerging markets Rural/Branchless Banking is a big area of growth in Mobile Finance. A majority of the agents and end customers, have lower end Java/J2ME/Symbian phones. Hence if the software does not support these low end phones, it beats the very purpose of Rural/Agency Banking. So, mobile finance solutions need to support these low end phones as well.

USSD/SMS Is Still Alive – Very Much in the Mobile Finance World

In many of the Emerging markets where Mobile Finance is growing, broadband coverage has not reached many areas especially rural parts. However, Mobile Finance has potential in these areas, and hence the software solution should be able to help serve these areas as well. So, every Mobile Software solution should be able to provide USSD and SMS support as well.

Network Quality Could Be Poor – But Don’t Make Mobile Money Customers Poor Due To That !

It is a reality of life in many of the emerging markets, to have poor quality of network connectivity. However, Mobile Money customers don’t want to suffer due to the same.

So Mobile Finance Software Solutions need to necessarily have features like being able to queue transaction related messages when network congestion / downtime happens, and to be able to send timely and proper messages conveying the same to the mobile user.

Importantly the messaging of the software solution with other systems should be optimized such that bandwidth requirements are less, given poor network quality.

Also Serve the Unfortunate Who Cannot Read and Write

A big scope of Mobile Finance business is to address the rural and urban poor segment of the target markets. Service Providers have to tap into this customer segment, even though some of them cannot read and write. So, the software solution they use has to have Dynamic IVR Support.

Have Flexible Deployment and Commercial Models

Mobile Service Providers while having a huge potential to grow their revenues and profits, need to first be able to start earning that with limited resources and skills. They also have complex revenue share deals with their end customers. Their technology solution partner can help them in this aspect, by providing flexible deployment models (Onsite Deployment and Remote Hosted Model), and flexible commercial models (CAPEX, and OPEX with Revenue Share). It helps the mobile service provider to be able to better manage their costs, operations, and cash flows.

Be True Technology Partners – Help Service Providers with Skills and Business Ideas

Many of the Mobile Finance Service Providers are not able to afford to have staff with the required skillsets, due to budget constraints or due to non-availability of the same in their market. There is potential for technology partners to help them, using Managed Services to help fill these gaps.

There is huge potential for technology partners to give business ideas to the mobile finance service providers. E.g. we recommended to and helped a Content Provider in West Africa save a lot of the

fees they were paying to the Telcos, by buying and using our Mobifin solution on their own to provide end users with a direct channel to buy their content using mobiles.

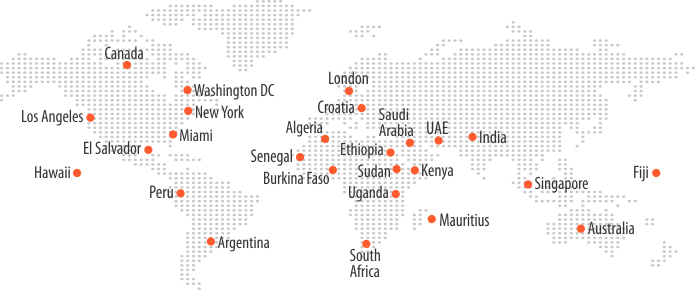

We have the fortune of observing the growth of Mobile Finance while working at Panamax Inc, through the deployments across the globe of our best digital banking platform called Mobifin. The above listed points are from the actual experience we have gained from this work we have done.

Please contact us at [email protected], if you are interested to have a discussion with us.